Work with FS Mode in Financial Statements

Review Financial Statements - Create and Modify for general information on how to setup financials statements.

There are three parts to creating a financial statement:

- Template Master: Think of this as setting up the rows you want displayed on your report. Rows can be setup for headers, to print general ledger accounts, for subtotals, totals, etc.

- Column Specifications: This step defines what data is in each column. A column may contain budget information, activity for selected periods, year to date activity or calculations such as budget verses actual.

- Financials Statement Master: The final step is to name the report and link to a Template Master and Column Specification.

These instructions explain how to use FS Group mode in a template as a way to group general ledger account numbers that cannot be easily grouped by the account number itself.

There are five FS Groups that may be used as an alternative grouping method in a Financial Statement. For each general ledger account that is to be included on the financial statement, enter a group code in one of the FS group fields (use the same one on each account number).

The group code can be any alpha numeric value you wish to use such as a line number on a form you will complete using this report, i.e. 1A, 1B, 1C, etc.

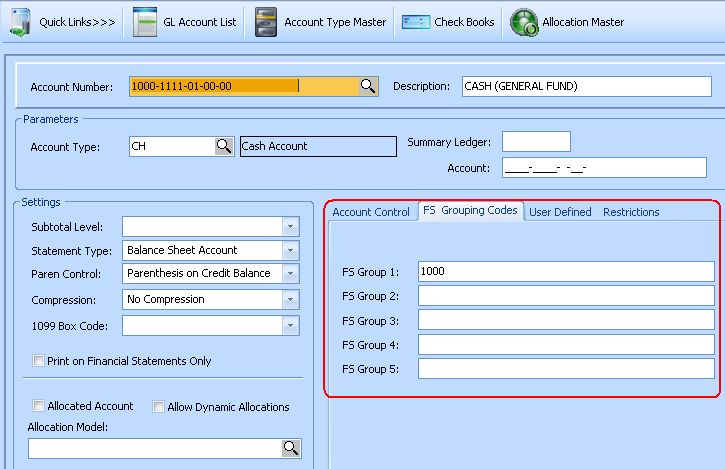

Setup FS Group on GL Account

NAVIGATION: MAINTAIN menu > GL Account Master

NAVIGATION: MAINTAIN menu > GL Account Master

- Click on the FS Grouping Codes tab.

- In the GL Account Master there are five FS Groups.

- Enter the FS group code in the appropriate FS group line.

- Click APPLY.

- Continue updating all GL accounts that you want included in the FS group.

Add FS Group to Template Master

NAVIGATION: MAINTAIN menu > Template Master

NAVIGATION: MAINTAIN menu > Template Master

- Click on the Setup Information tab.

- In the ACCOUNT MODE field, select one of the five FS Grouping options. The FS Grouping option selected should be the FS Group # that you have entered a FS Grouping Code in for the GL Account Master.

- On the DETAIL INFORMATION tab, use the AP function for the line you want to add a FS group.

- Do not use the ARP Function to find account activity. Always use the AP Function.

- Enter the FS group code from the GL account master in the starting account column.

- Always leave the Ending Account column blank.

- In the DESCRIPTION column, enter text that that you want to appear on the report as the Line Description.

-

OS and LF should both have a value of 1 for most reports.

- These values may be changed using the rules in How to Create and Modify Financial Statements.

- Tab to the next line to save OR click APPLY at the top of the screen.

IMPORTANT NOTES REGARDING USING FS GROUPING

IMPORTANT NOTES REGARDING USING FS GROUPING

- When using FS grouping, there is no other filtering method.

- All general ledger accounts in this company that have the same FS group code in the selected grouping field will be included in the total on the Financial Statement.

- See Financial Statements Process for instructions on using FS grouping with column filtering.

- DO NOT enter filters in Advanced Filtering as these will not work with FS reporting.

Complete the Report

- Create a report code that is tied to the Template and Column Specification in the Financial Statement Master. See How to Create and Modify Financial Statements for instructions on completing the Financial Statement Master and more details on how Financial Statements work.

- Always test new reports by running Trial Balance reports or other Financial Statements that will contain the same data.

- You may need to combine the totals of different statements or groups of accounts from a Trial Balance to double check that the new report totals contain all of the expected accounts.

FS GROUP EXAMPLE

This example shows six accounts with values in FS Group 1 and FS Group 2

| ACCOUNT # | FS GROUP 1 | FS GROUP 2 | VALUE |

| 100-101 | 10 | 10 | 500.00 |

| 100-102 | 10 | 10 | 200.00 |

| 200-101 | 10B | 10 | 300.00 |

| 100-111 | 11 | 11 | 200.00 |

| 200-111 | 11 | 11 | 300.00 |

| 200-112 | 11B | 11 | 400.00 |

FS Master Template Setup

| FUNCTION | COMP | STARTING ACCOUNT | ENDING ACCOUNT | DESCRIPTION | OS | LF |

| AP | 10 | CASH | 1 | 1 | ||

| AP | 11 | RECEIVABLE | 1 | 1 |

This Master Template setup using Account Mode FS Group 1 with these two detail line will display these results:

- CASH line - FS Group 10 listed in Starting Account column

- Accounts 100-101 & 100-102 will be included in the first line "FS group code 10" total.

- 200-101 has an FS Group 1 value of 10B and will NOT be included.

- Since FS Grouping 1 is the selected grouping method, the 10 in FS2 has no effect on this statement.

- RECEIVABLE line - FS Group 11 listed in Starting Account Column

- Accounts 100-111 and 200-111 will be included in the second line "code 11" total as these have the FS Group 1 value of 11.

- 200-112 will not be included with a value of 11B.

Changing the Master Template setup to Account Mode FS Group 2 with these two detail line will display these results:

- CASH line

- Accounts 100-101, 100-102, and 200-101 will be included in the first line "Code 10" total now

- RECEIVABLE Line

- Accounts 100-111, 200-111 and 200-112 will be included in the 2nd line "Code 11" total now.

12/2023