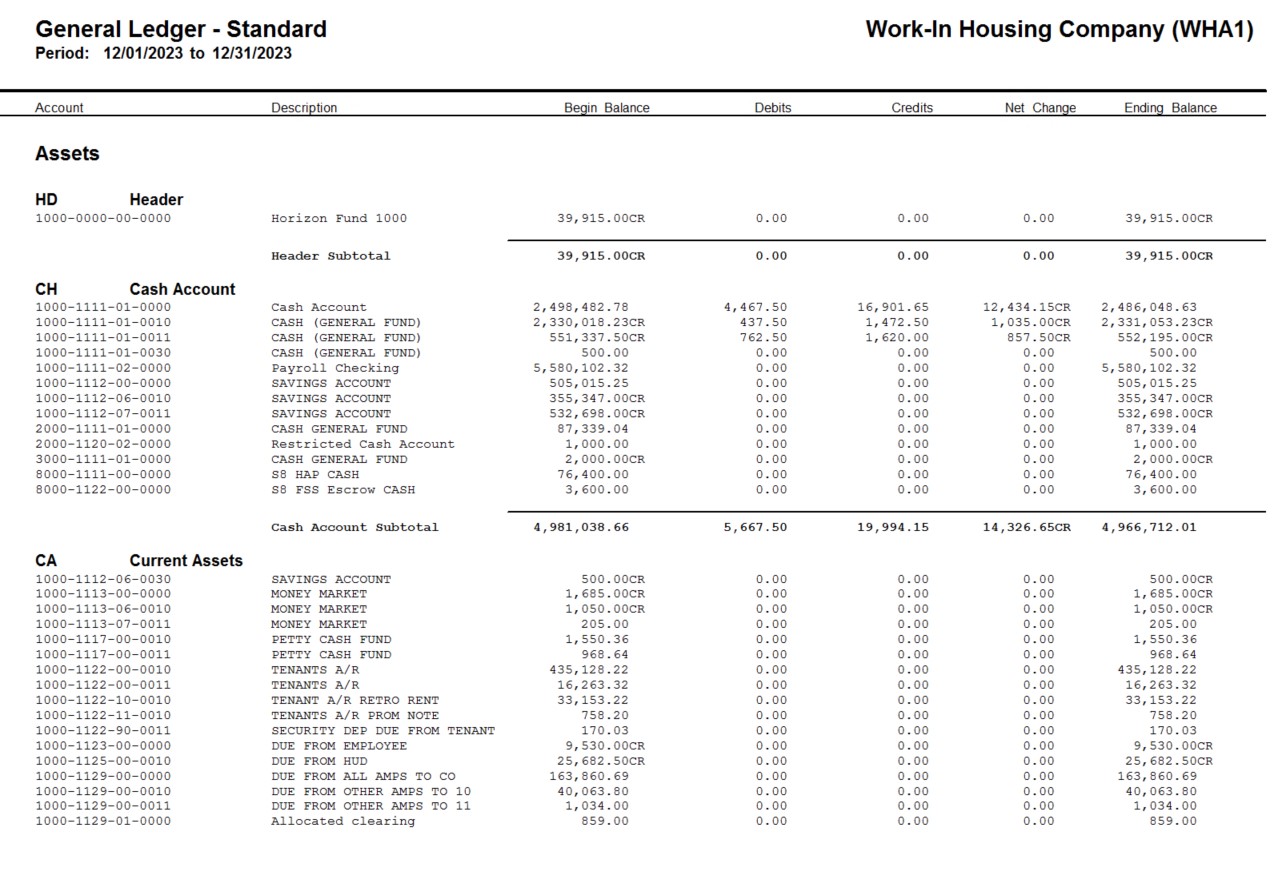

General Ledger Standard Report - Balance Sheet and Income Statement

The General Ledger Standard Report is your basic financial statement report and includes both a Balance Sheet and an Income Statement. Horizon does not recommend using this report in detail format. For a detail report, use the General Ledger Trial Balance Report.

- Balance Sheet

- The first part of the report contains the Balance Sheet section. In the first section, each GL Account Type will be subtotaled.

- Assets will be listed first with an asset total. Liabilities will be next followed by Equity Accounts.

- After equities is a line called Current Year Net Income. This line is the total of all Income and Expense accounts.

- Next is an Equity Total that includes the Current Year Net Income. Listed last is the Liabilities and Equity Total.

- For the Beginning and Ending Balance columns; the Liabilities and Equity Total should match the Asset Total line. If they do not match the General Ledger may be out of balance or some general ledger accounts may be setup incorrectly.

- If you need assistance in determining why these totals do not match, please call the Horizon Help Desk.

- Income Statement

- The second part of the report contains the Income Statement section.

- Each GL Account Type on the report will be subtotaled.

- Revenues will be listed first with an Income/Revenue Total.

- Expenses are next with an Expense Total.

- This will be followed by the Current Year Net Income line. This line should match the Current Year Net Income from the Balance sheet section.

To create custom designed financial reports, use the Financial Statement Setup options, available under the Maintain menu.

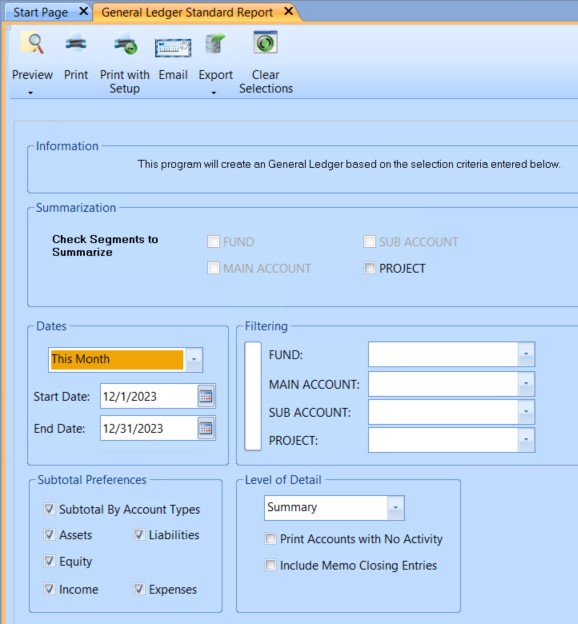

NAVIGATION: REPORTS menu > General Ledger Reports > Standard Report

NAVIGATION: REPORTS menu > General Ledger Reports > Standard Report

- Check Segments to Summarize

- Depending upon account setup there may be one to nine segments available for summarization.

- Segments that are checked, beginning with the last segment, will be summarized up to the preceding segment. No detail will print for the checked segment.

- All segments are dimmed, except the segment that is available to select.

- As segments are checked, the preceding segment will become available.

- Dates: enter or select one of the following:

- This Month

- Last Month

- This Quarter

- Last Quarter

- 1st Quarter

- 2nd Quarter

- 3rd Quarter

- 4th Quarter

- This Year

- This Year to Date

- Last Year

- Last Year to Date

- Custom (allows you to select your own dates)

- All (the from date is blank and the ending date is the current date)

- Start Date and End Date: Based on the date criteria selected, the start and end date will automatically fill in with a date range with the following exceptions:

- If Custom is selected the start and end dates will be blank allowing the user to enter a "custom" date range.

- If All is selected, the beginning date is left blank and the ending date will be the current date.

- Displayed dates for any selection may be edited.

- Filtering

- Enter or select a general ledger account segment value, into the appropriate segment field, to generate a trial balance with all occurrences of that segment value within the other options selected.

- For example: If your first segment had numerical values in the general ledger account structure of 01 - 99. You could choose to enter the numerical value of 22 in the first segment filter field. All account numbers that began with 22 would be included on the report.

- Subtotal Preferences: Check one or several of the following subtotal options for the report.

- Subtotal by Account Types: If this field is checked, a subtotal will be generated in the report for each account type code. Account type codes are setup and maintained by the user in the Account Type Master.

- Assets: Check this field to have the report generate a subtotal for all assets. Account Type codes are tied to the Asset account type classification in the Account Type Master.

- Liabilities: Check this field to have the report generate a subtotal for all liabilities. Account Type codes are tied to the Liability account type classification in the Account Type Master.

- Equity: Check this field to have the report generate a subtotal for all equity accounts. Account Type codes are tied to the Equity account type classification in the Account Type Master.

- Income: Check this field to have the report generate a subtotal for all income accounts. Account Type codes are tied to the Income account type classification in the Account Type Master.

- Expenses: Check this field to have the report generate a subtotal for all expenses. Account Type codes are tied to the Expense account type classification in the Account Type Master.

- Level of Detail: Select one of the following levels for the trial balance:

- Summary - The trial balance will only print the balances for each account number listed. Detail will not be included. This is the best option for this report.

- Detail (Memo)- When the source is AP the report will show the accounts payable distribution reference information.

- Detail (Desc) - When the source is AP the report will show the accounts payable vendor.

- Detail (Both) - When the source is AP the report will show both the accounts payable distribution reference information, the accounts payable vendor, vendor number and line number.. (Note: The report will have more pages as each AP source will show two lines of information)

- Expanded - For compressed mode of posting, expanded will print out a line for every entry posted to an account.

- Print Accounts with No Activity: Place a check mark in this field if you want accounts that have no activity for the date range selected to print on the report.

- Include Memo Closing Entries: When this field is checked, memo closing entries will be included on the trial balance report.

- Print, preview, or save the report (see Report Preview, Print and Save Options).

- The classifications you see on this report come from the GL Account Master where each account is assigned to an Account Type.

- If you would like to change Account Types or add additional Account Types, please contact your Horizon Support Representative for assistance.

- SAMPLE

See Also: Financial Statements Process

12/2023