Edit 1099 Information

This step will allow you to any information that will appear on the 1099. Once the AP and the S8 pulls have been completed, both sets of data will be combined in this Edit Utility.

More Information

- If you recorded state tax withholding during the year:

- The pull will split the withheld amount between MISC and NEC based on % split of total payments.

- If you do not agree with the amounts, you may make corrected in this view.

- Example: If you have paid a vendor $4,000 for the year $3,000 for NEC, $1,000 for MISC. 75% NEC, 25% MISC. And have withheld $400 it will split the withholding as $300 NEC, $100 MISC.

- State Income

- If there was State Tax Withheld, then the State Income box will be completed with the total of all payments shown on this form.

- If only part of this income is for the state withheld for, please manually correct the State Income amount.

- State ID

- If there is State Tax Withheld you will need to enter the state abbreviation, a space, your eight digit state ID.

- Example: PA 12345678

- Federal Tax Withholding

- If you are entering Federal Tax Withholding on payments, the pull will split the withheld amount between MISC and NEC based on % split of total payments, Same process as for State Tax.

- If you do not agree with the amounts, you may make corrected in this view.

- The Reporting Group field has been added to assist in manually adding 1099 information to a specific Reporting Group.

- If you pull again using Re-Create or Remove options after editing the 1099s, any edited information will be deleted and replaced.

Edit Information

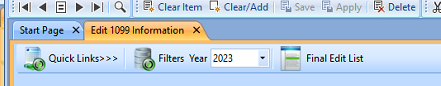

NAVIGATION: UTILITIES menu > 1099 Processing > Edit 1099 Information

NAVIGATION: UTILITIES menu > 1099 Processing > Edit 1099 Information

- At the top of the form is the YEAR filter. Check that the correct reporting year is selected.

- In the CONTROL NUMBER field, click the browse icon.

- Select the vendor you want to edit.

- Click OK.

- Edit/change vendor information

- Edit any information that was not corrected in Step 1.

- Use the MISC, NEC, and Interest tabs to view/edit data for the type of form to be submitted

- Click SAVE.

- To delete a record from the 1099 file:

- In the CONTROL NUMBER field, click the browse icon.

- Select the vendor you want to delete. Click OK.

- Make sure your cursor is in the CONTROL NUMBER field.

- Click DELETE.

- Click YES when prompted.

- To manually add a 1099 to the file:

- Click Clear/Add

- Leave the CONTROL NUMBER field blank.

- Enter all necessary information.

- Click SAVE.

NOTE: The electronic 1099 (S8 Only) checkbox will flag the 1099 to not print the vendor copy and only send to the Stratus DocumentViewer Service. This should only be used for Section 8 Landlords that will access their 1099 from Stratus DocumentViewer.

12/2024