2024 Year End Payroll Guide

The 2024 Year End Payroll Guide reviews information related to closing payroll for 2024 and setup for 2025 payroll.

If you have any problems with the help files or have questions, please submit a ticket for the Horizon Help Desk (SUPPORT menu > Submit a Ticket) or call 814-535-7810.

Important Information for 2024/2025

- Payroll will need to be closed for 2024 and set up for 2025.

- Closing 2024 does NOT delete any data. You will be able to run reports for 2024 and for any previous year that was processed in Horizon.

- Do NOT start processing W2’s before closing. The recommended best practice is to close the year 2024 and on a later date in January, start processing your W2s.

- Before closing 2024, you must complete all pays that the payment/check/ACH date are in 2024.

- This includes regular pay, bonus checks, adjustments, third party sick pay, etc.

- If the pay was made available to your employees in 2024, then it is required to be in the 2024 W2 totals.

- Before processing any payment/check/ACH date in 2025, you must close 2024 and set up for 2025.

- If you are processing a pay period (work dates) for 2024 that will be paid in 2025, this is a 2025 payment. You must close 2024 before running this.

- If you find you need to adjust an employee’s 2024 information after closing, there is a process to set the employee back to 2024 totals, process adjustments, then set employee to 2025 totals again.

- If you receive third party sick pay information after your first 2025 pay, you may use the above process to enter the third-party sick pay. Contact the Horizon Help Desk for assistance.

- 2025 Accounting Period Master may need created.

- If your Fiscal year ends on 12/31/2024, before you can process a 2025 pay date, fiscal staff must create the new fiscal year.

- If you receive an error when processing the first 2025 pay, then it is very likely that the 2025 fiscal year has not been created. The error will state “Accounting Period Problem for Pay Date”.

- Contact your Fiscal staff to create the year so you may proceed.

Payroll Management Update

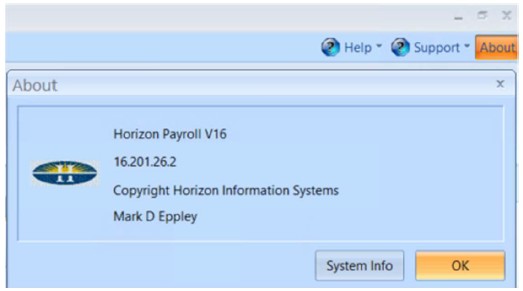

- The latest Payroll Management software update is REQUIRED to close the payroll year, start processing 2025 payroll, and print 2024 W2 forms.

- Verify the version of your system. Contact the Horizon Help Desk if you need an update.

- December Horizon Software update to Payroll Management version 16.201.26.2 or later.

- Check your version in payroll on the top right About option.

Close 2024 Payroll

- The latest Payroll Management software update is REQUIRED to close the payroll year and start processing 2025 payroll.

- December Horizon Software update to Payroll Management version 16.201.26.2 or later.

- Check your version in payroll on the top right About option.

- You must complete the Payroll Year End Process after the last pay has been processed for any 2024 pay date and before the first pay date of 2025.

- This includes all 2024 bonus checks and corrections.

- If your check date and/or ACH date will be 2024, then it is still for 2024.

- Do not close 2024 payroll until all 2024 checks are completed.

- Closing the year does not delete employee history.

- You do NOT need to start processing the W2s before closing the payroll year.

- Before the first check/ACH dated in 2025 run the Payroll Year End Close processes.

- Do not change your ACH upload date between years.

- The W2s (as required by Federal Law) will be for payments available to the employees in the year 2024.

- Changing the ACH processing date between years in the upload to bank from how it processed in Payroll will cause incorrect reporting.

- For complete instructions on how to close payroll, review Process Payroll End of Year.

- Closing the year does not delete employee history.

- You do not need to start processing the W2s before closing.

Pay Date Master – Federal Reserve Holidays

The Federal Reserve Holiday schedule is below. On these dates, ACH will not process. If a scheduled payday should fall on a Federal Holiday, you should adjust your pay date to the work day before or after the Holiday.

- Christmas Day - 12/25/2024

- New Year's Day - 1/1/2025

- Martin Luther King Jr. Day - 1/20/2025

- Washington's Birthday - 2/17/2025

- Memorial Day - 5/26/2025

- Juneteenth National Independence Day - 6/19/2025

- Independence Day - 7/4/2025

- Labor Day - 9/1/2025

- Columbus Day - 10/13/2025

- Veterans Day - 11/11/2025

- Thanksgiving Day - 11/27/2025

- Christmas Day - 12/25/2025

For instructions, refer to Pay Date Master

Year-End Payroll Accrual

- You can record the year-end payroll accrual if your fiscal year ends on December 31st, and you would like the payroll program to allocate the payroll expense of your first pay between 2024 and 2025.

- Remember, during the close process and setup of 2024 pay periods in the Pay Date Master, you may set the Accrual Date to 12/31/2024.

- This must be done before you run the Auto-Setup Time Cards for that pay.

- When you run the Auto-Setup Time Cards, it will split the time into two dates, 12/31/2024 and the pay period end date.

- Time card entries dated 12/31/2024 or before will be expensed on 12/31/2024.

- Time card entries dated 1/1/2025 or after will be expensed on the pay period End Date.

2025 Tax Rates – Automated Tax Update

- The Automated Tax Update process will update:

- Federal Income Rates

- Social Security Rates

- Medicare Rates

- Pennsylvania State Tax Rates

- For other states not Pennsylvania, if your state tax rates are changing, please contact the Horizon Help Desk for assistance.

- Pennsylvania PSD Local Rates

- Horizon will be using the latest rates from the PA Municipal Statistics Web Site.

- Updating the PSD rate list can take a few minutes.

- The automated tax update process will not update; these rates need manually updated

- Pennsylvania Unemployment Rates (employee or employer)

- FUTA taxes

- The Automated tax Update has options to not update all taxes. You may exclude a tax by unchecking the box.

- If you do not use Pennsylvania local PSD taxes, unselect it

- If you do not withhold Medicare, unselect it to keep the previous 0% rate.

- After running the update process, please review your tax rates to verify that they are correct.

- If you have fast Internet speeds, expect 1 to 5 minutes to update. With slower Internet speeds, you may want to start the Tax update before taking a break or leaving for lunch. When “PSD Table Updated” appears, the update is complete.

- If you do not have Internet or your network blocks this process, you may update the rates manually.

Automated Tax Update Steps

NAVIGATION: UTILITIES menu > Automated Tax Update

- There are four check boxes for the taxes to update. To exclude any of the updates, un-check the box.

- Click the UPDATE PROCESS button on the Quick Links bar

- An information box will open showing the year that the online tax information available is for “2025 Tax Year Update 12/13/2024 – Update?”. Click YES to update your tables or NO to cancel.

- This update may take a few minutes as it verifies all the local tax codes and rates.

- When the information box stating “PSD Table Updated” appears, the update is complete.

Detail Information on 2025 Payroll Tax Rates

- Federal Income Rates

- The IRS has released the 2025 tax bracket tables. Horizon has updated the Automated Tax Update with the new 2025 tax tables and are ready to process.

- FUTA

- The Automated Tax Update process WILL NOT update FUTA.

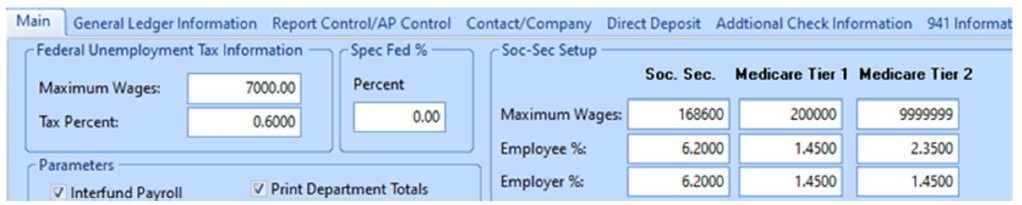

- If you need to adjust FUTA taxes manually, go to Payroll Settings > Main tab

- The effective FUTA rate remains 0.6% on the first $7,000.

- This is calculated from the FUTA Gross of 6.0% less the State 5.4% allowance.

- Social Security Rates

- The Automated Tax Update process will update Social Security.

- The wage base is increasing from $168,600 in 2024 to $176,100 for 2025.

- The employer rate remains at 6.2%.

- The employee withholding will also remain at 6.2%.

- Medicare Rates

- The Automated Tax Update process will update Medicare rates.

- The current rates of 1.45% for employee and employer will continue for employees that earn less than $200,000.

- Wages over $200,000.00 have an additional tax of .9% withheld.

- There is no Employer match of this additional tax.

- You may have noticed the Medicare Tier 1 & Medicare Tier 2 on the screen above that addresses these rates.

- Pennsylvania State Tax Rates

- The Automated Tax Update process will update Pennsylvania state tax rates.

- There are no changes in the PA Income Tax rates.

- The current rate of 3.07% will continue for 2025.

- If you withhold state tax for any other state, contact the Horizon Help Desk for assistance with announced rate changes.

- Pennsylvania PSD Local Rates

- The Automated Tax Update process will update Pennsylvania PSD Local tax rates.

- Horizon provides the rates published by the state of Pennsylvania.

- If you received notice from a local tax collector about a rate change for January 2025, after running the Automated Tax Update, verify that the rate is the new one. The PA published rates have been known to not include all the new increases.

- Pennsylvania Unemployment Withholding Rates

- The Automated Tax Update process will NOT update Pennsylvania Unemployment rates for the employee or employer.

- EMPLOYEE RATE

- The 2025 rate will remain at .07% with no maximum.

- If the Employee withholding is calculated in Payroll, go to Maintain menu > Deduction/Benefit Master

- Open your Unemployment Benefit code.

- Under Employee, Amount should be .0700.

- Type should be % - Percent Amount.

- Maximum should be 999999.99.

- Retain Maximum at Year End should be check marked.

- Press Apply then press the QuickLink - Global Changes.

- Put a check mark in each box for Employee Amount, Type, Maximum.

- Do NOT check any other boxes. Do NOT add dates to the start/end date fields.

- Click the UPDATE button.

- This will update every employee that already has this benefit to the new rate settings.

- EMPLOYER EXPENSE RATE – These instructions are for calculating the Employer Expense during payroll for GL distribution. The UC quarterly reports do not use this rate.

- The maximum Taxable Wages will remain at $10,000.00 in 2025.

- Use the rate supplied to your company. UC Tax rates may be recorded in two places. Please follow these steps.

- If the Employer expense is calculated in Payroll, go to Maintain menu > Deduction/Benefit Master

- Open your Unemployment Benefit code.

- Under the Employer, enter your company’s tax rate.

- Type should be % - Percent Amount.

- Maximum should equal your rate times 10,000.00, such as if your rate is 3% then .03 X 10,000.00 = 300.00.

- Retain Maximum at Year End should be check marked.

- If you changed this rate, continue to the next step.

- Press Apply then press the QuickLink - Global Changes.

- Put a check mark in each box for Employer Amount, Type, Maximum.

- Then press the Update button.

- This will update every employee that already has this benefit to the new settings.

- AFTER COMPLETING YOUR 2024 UC REPORTS, COMPLETE THIS STEP.

These instructions are to update the Employer rate used for the UC quarterly reports.- Do NOT complete these steps until after completing your 2024 UC final report.

- Remember to update this rate before starting first quarter 2025 reports.

- Recommended: place a reminder on your calendar with the following instructions to update the State UC Tax rate on a day before you would begin the first quarter UC reports.

- Go to MAINTAIN menu > State Taxes

- Open the State browse, select the PA S(single)

- The Maximum should be 10,000.00

- The Percent amount should be your rate supplied by PA Unemployment.

- Click SAVE.

For instructions, refer to Deduction or Expense for All Employees

Entitlement Rollover Process (Optional)

- If you track entitlements, the entitlement Rollover Process should be done after the last pay period that includes the time card date December 31, 2024.

- For instructions, refer to Rollover Entitlements at Year End

Employer Paid Health Care – W2 Reporting

- If you have not already recorded the cost of Employer Paid Health Care in Payroll, you can enter it directly on the W2 forms.

- For 2024 reporting of W2, this entry is mandatory if you submitted 250 or more W2s for 2021; if fewer, then it is optional.

- For instructions, refer to Enter the Cost of Employer Health Coverage to an Employee's W2

Printing 2024 W2 Forms

- The latest Payroll Management software update is REQUIRED to print W2 forms or create an electronic submission file

- December Horizon Software update to Payroll Management version 16.201.26.2 or later.

- Check your version in payroll on the top right About option.

- You can pull the employee data and edit the W2’s with an older version. Wait to print W2 forms until your Payroll Management system is updated.

- If you are running an earlier version of Payroll Management, please check with your company’s primary Horizon contact to see when you are scheduled for the update.

- For the full instructions on how to process and print W2 forms, see Process W2 Forms

- Also review the instructions for Create an Electronic W2 Submission File for the IRS or State.

- The IRS has discontinued the downloadable AccuWage, the current submission file verification too can be accessed by logging into Business Services Online (BSO) to access AccuWage Online.

- For instructions, refer to Overall W2 Process

12/2024