Import Expense Entries

This process will import expense transaction information from a CSV spreadsheet. The CSV spreadsheet MUST have the correct column headers to import correctly. After the process has run, the entries will display in the Expense Entry (found under Activities menu).

Setup the CSV Import File

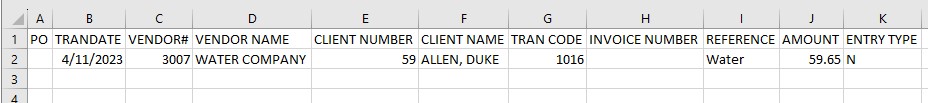

The CSV spreadsheet MUST have the correct column headers to import correctly. CSV spreadsheet column headers are as follows and must be in this order:

- PO

- TRANDATE

- VENDOR#

- VENDOR NAME

- CLIENT NUMBER

- CLIENT NAME

- TRAN CODE

- INVOICE NUMBER

- REFERENCE

- AMOUNT

- ENTRY TYPE

Complete the Import File with Expense Information

Each row of the csv file will import as one transaction/expense entry. If any of the required fields are missing or incorrect, the import process will stop and no entries will import.

- Enter the * required fields on each row in the CSV import file.

If any of the required fields is missing, the expenses will not import.

If any of the required fields is missing, the expenses will not import.

- TRANDATE* - date of the transaction

- VENDOR#* - vendor number as listed in the system

- VENDOR NAME* - vendor name as listed in the system

- CLIENT NUMBER* - client number as listed in the system

- CLIENT NAME* - last name, first name of the consumer

- TRAN CODE* - the transaction code the expense should be coded as; do not include a hyphen in the code; enter digits as 1013 - not 10-13

- AMOUNT* - amount of the expense

- ENTRY TYPE* - Y is Account Payable (a check needs cut) N - Non Accounts Payable (record electronic payment)

- Optional fields for each expense include:

- PO - if you use purchase orders, enter the PO number

- INVOICE NUMBER - if you track invoice numbers, enter the number

- REFERENCE - general note about the expense

- Save the file on your computer as a CSV file.

- Log into the Stratus Rep Payee program.

If you open a csv file, do not convert the file to Excel format. Once you save the file as a .csv format, do not reopen the file in Excel format as this will create improper formatting.

If you open a csv file, do not convert the file to Excel format. Once you save the file as a .csv format, do not reopen the file in Excel format as this will create improper formatting.

Import the File

If any of the required fields are missing or incorrect, the import process will stop and no entries will import. Review the import errors to fix the csv file, then reimport.

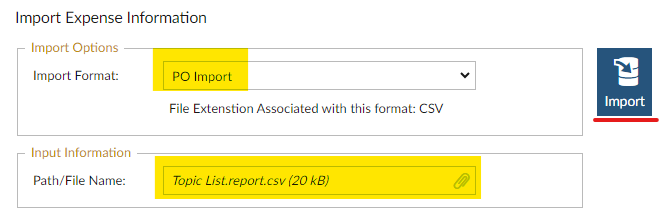

NAVIGATION: UTILITIES menu > Exports/Imports > Import Expense Information

NAVIGATION: UTILITIES menu > Exports/Imports > Import Expense Information

- Import Format: select PO Import

- Path/File Name: select the saved CSV file. File extension must be .CSV

- Click the paperclip

- Navigate to where you saved the file on your computer

- Double click on the file

- The file name will then be displayed in the field

- Click IMPORT

- When the process is complete, a prompt will appear. Click OK

- The entries will be available in the Expense Processing > Expense Entry area to review, edit, and post.

Correcting Import Errors

If any of the required fields are missing or incorrect, the import process will stop and no entries will import. Review the import errors to fix the csv file, then reimport.

- If the are errors in the csv (i.e., wrong client number, missing date, etc.), the import process will stop and no expenses will be imported.

- An error message will appear for each line that has incorrect/missing information. The message will tell you what is wrong, i.e., client number is invalid, invalid date, etc.)

- Review the error messages to see the specific line in the file that has an error.

- Open the csv file.

- Go to the line and correct the incorrect/missing information.

- If you get the error about lines that have nothing in them, delete the row and try again, i.e., invalid data on line 75; line 75 in the file does not have anything entered - delete the entire row

- Save the csv file and import the updated file.

Review Edit List

The Expense Edit List will show you expense transactions to review before posting. Horizon suggests that you preview your Edit List to identify any errors in expense entry before posting.

Expense transactions that have not been posted can be modified/saved. Once an expense transaction is posted, it cannot be modified and another expense entry would need entered to correct the error.

NAVIGATION: ACTIVITIES menu > Expense Processing > Expense Edit List

NAVIGATION: ACTIVITIES menu > Expense Processing > Expense Edit List

- Preview, print, or save the report (see Report Preview, Print and Save Options)

- If you identify an error on one of the entries, go back to Expense Entry to correct.

- Go to the last page of the report.

- Make sure the overall count and total match your csv import file

Post Expenses

Once you are satisfied the expense entries are correct, post the expenses.

![]() NAVIGATION: ACTIVITIES menu > Expense Processing > Post Expenses

NAVIGATION: ACTIVITIES menu > Expense Processing > Post Expenses

- Preview, print, or save the report (see Report Preview, Print and Save Options)

See Also: Process Expense Transactions

11/2023