Reconcile the Checkbook

The bank reconciliation is how you make sure your records match your bank's record. You check for any differences and fix them. The last step is to verify the check book balance equals the client balances.

What To Do Before You Start

- Make sure all deposits, checks, and electronic payments are posted

- Make sure all expenses are posted and checks are processed

- Enter any missing transactions from the bank statement

Steps to Reconcile

- Go to Reconciliation from the ACTIVITIES menu, pick Checkbook Reconciliation > Reconciliation Process.

- Pick the Checkbook: From Checkbook ID, choose the checkbook

- Enter Statement Information

- Statement Balance – type in the bank statement’s ending balance

- Statement Date – enter the end date from the bank statement

- Adjustments/Bank Errors – If there are any bank errors requiring adjustments, enter the amount here.

- Click START RECONCILING.

- You will see outstanding deposits in the top Deposits/Credits section and outstanding checks in the bottom Checks/Withdrawals section.

- Mark Cleared Items:

- Look at your bank statement.

- Check off anything that cleared the bank.

- To clear a group of checks, enter a range of check numbers in the white fields and click PROCESS RANGE.

- Check Totals:

- The Cleared Deposits total on the bank statement should match the cleared deposits total on the screen

- The Cleared Checks total on the bank statement should match the cleared checks total on the screen

- Make sure the “Difference” is $0.00. That means everything matches.

- If the difference is not zero, research and fix any discrepancies. If a correction is needed:

- Exit the reconciliation process.

- Enter the missing transactions as an expense or non-AP checks.

- Return to the reconciliation process; previously marked items will remain checked.

Finish the Reconciliation

Only when the Difference is $0.00:

- Click PROCESS RECONCILIATION.

- Click YES to finish.

- This will update the checkbook with the cleared items from the reconciliation.

Reports to Print When Done

- Reconciliation Balance Report (Reconciliation Summary Report)

- Provides a summary of the reconciliation, including cleared transaction totals for the month.

- Navigation: ACTIVITIES menu > Checkbook Reconciliation Section > Balance Report

- Pick the checkbook ID

- End Date: the end date should always match the bank statement ending date

- Check the NOTIFY box and RUN REPORT button.

- Preview, print, or save the report (see Report Preview, Print and Save Options)

- Outstanding Item List

- Lists all deposits and checks that remain uncleared after reconciliation.

- Navigation: ACTIVITIES menu > Checkbook Reconciliation Section > Outstanding Item List

- Pick the checkbook ID

- End Date: the end date should always match the bank statement ending date

- Check the NOTIFY box and RUN REPORT button.

- Preview, print, or save the report (see Report Preview, Print and Save Options)

- Cleared Items List

- Shows all deposits and checks that were marked as cleared during the reconciliation process.

- Navigation: ACTIVITIES menu > Checkbook Reconciliation Section > Cleared Items List

- Pick the checkbook ID

- Start/End Date: make the dates match the month of the bank statement; the end date should always match the bank statement ending date

- Check the NOTIFY box and RUN REPORT button.

- Preview, print, or save the report (see Report Preview, Print and Save Options)

Reconcile Checkbook with Client Balances

Reconcile the checkbook ending balance with the client balances.

- Run the Client Balance summary report

- NAVIGATION: Reports menu > Client Balance Reports > Client Balance Summary

- Client Number: Leave the Client number blank for all.

- Start date and End date: enter as the month of the reconciliations, such as 7/1/2023 to 7/31/2023

- Pay Group: Select the Paygroup for the checkbook being reconciled.

- Run Report

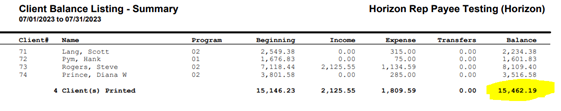

- Go to the second to last page. Record the final total under Balanced column.

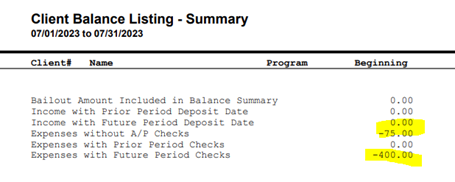

- Go to the last page. Record the amounts in the rows “Expenses without A/P Checks” and “Expenses with future Period Checks.

- Add back the expense values to the client balance total

- Example to calculate client balance

- Client Balance = client total balance (next to last page) PLUS Expense without A/P Checks PLUS Expenses with Future Period Checks (last page)

- $15,462.19 + 75.00 + 400.00 = $15,937.19

- $15,937.19 is the total client balance and should equal your checkbook balance for 7/31/2023

Bank Reconciliation Help

If the difference is not zero after marking all cleared items, here’s how to track down common errors:

- Review Transaction Dates:

- In the reconciliation screen, only transactions dated on or before the statement date will appear.

- A transaction may be missing because it was entered with a future date.

- Go to your checkbook register and search for the transaction.

- If needed, edit the date so it matches the period being reconciled.

- Check for Incorrect Amounts:

- Compare the transaction amounts in your checkbook against the amounts on the bank statement.

- Look for: Miskeyed check or deposit amounts, Missing decimal points, Reversed digits

- Look for Duplicate Entries:

- Use the Checkbook Register to look for duplicate checks or deposits that could cause an overstated balance.

- Cancel or void any accidental duplicates before returning to reconcile.

- Investigate Outstanding Items:

- Print the Outstanding Item List to compare against prior months.

- If a check or deposit has remained outstanding for several months, it may indicate:

- A check that was voided but not recorded properly

- A deposit that wasn’t actually made

- A posting error

- Use Reports to Assist:

- Print and compare the: Cleared Items List, Outstanding Items List, Reconciliation Balance Report

- These reports help identify what was included or excluded from the reconciliation and can reveal inconsistencies.

- Review Voided Checks

- Be aware that voided checks with a void date before the statement date will not appear in the reconciliation window, as the system automatically clears them.

Reconciliation Documentation

Maintain copies of all reconciliation reports for auditing and reference purposes. Save and/or print reports for your records. Monthly Reconciliation Packet should include:

- Bank Statement

- Balance Report

- Outstanding Item List

- Cleared Items List

- Any posting registers from corrections

- Client Balance Summary

5/2025